Earlier this month, the Social Security Board of Trustees and the Medicare Board of Trustees released annual reports on the short and long-term financial status of the health of the Social Security and Medicare Trust Funds. Under the Social Security Act, the Social Security Board of Trustees must report on the status of the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds, while the Medicare Board of Trustees is required to report on the Hospital Insurance (HI) and Supplementary Medical Insurance (SMI) Trust Funds. The 2024 releases, representing the 84th edition and 59th edition, respectively, bring to light five significant findings and projections:

-

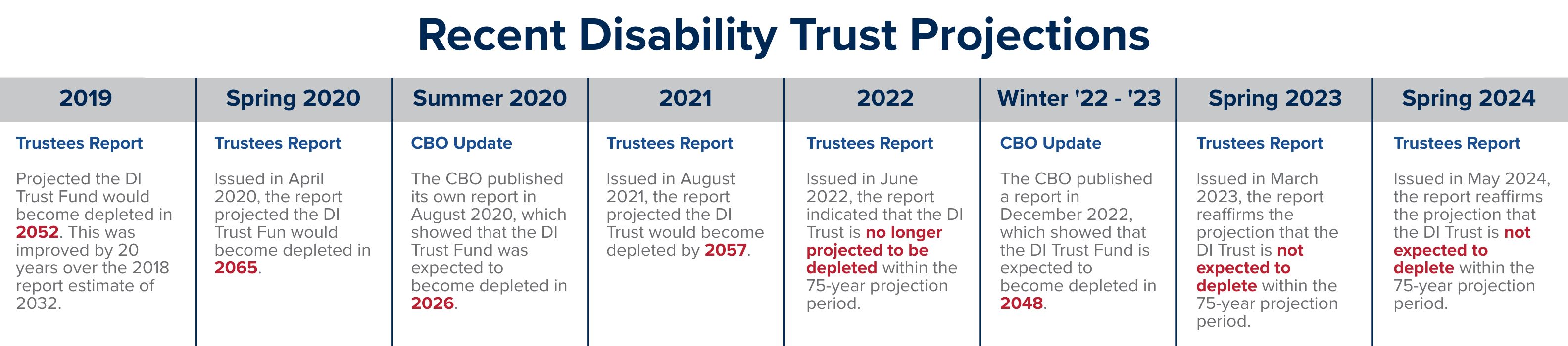

- For the third year in a row, the Trustees affirm that the Disability Insurance Trust Fund asset reserves will not be deleted until after the current 75-year projection period (2024 – 2098).

- In a projection unchanged from last year, the Old-Age and Survivors Insurance Fund is projected to become depleted in 2033, with 79% of benefits payable at that time.

- The combined assets of the Old-Age and Survivors Insurance and Disability Insurance Trust Funds are projected to deplete in 2035, with 83% of benefits payable at that time; this is one year later than last year’s projection.

- The Trustees project that the Health Insurance Trust Fund will become depleted in 2036, with 89% of incurred program costs covered at that time, five years later than last year’s projection.

- The Supplementary Medicare Insurance Trust Fund is expected to remain adequately funded indefinitely because of its primary funding sources.

Reporting at odds with the Congressional Budget Office

Each year, the Congressional Budget Office (CBO) publishes long-term projections for the Social Security Administration and the Medicare program in the Long-Term Budget Outlook, with additional information published in supplemental reports. The reporting typically comes out at different times than that of the Trustees and is often at odds with the reporting from the Board of Trustees. The most recent report published by the Congressional Budget Office predicts the Disability Insurance Trust Fund will become depleted nearly 50 years earlier in 2048, and the Hospital Insurance Trust Fund will become depleted five years earlier in 2031.

So, what accounts for the differences between the Congressional Budget Office’s report and the annual report published by the Boards of Trustees? While both project the eventual insolvency of the Trust Funds, each makes a different assumption when looking at economic and demographic considerations. The Gross Domestic Product, inflation rate and fertility rate are just some factors considered when projections are made, with the Trustees and Congressional Budget Office often disagreeing. These differences in assumptions can lead to significant variations in projected depletion and solvency dates.

Looking toward the future and solvency of the Trust Funds

The funding of the two Social Security Trust Funds has long been a source of contention and deliberation for lawmakers. Once again, the Social Security Administration is expected to pay more in benefits than income received, a projection expected to remain in perpetuity. With the Old-Age and Survivors Trust Fund failing the test of short-range financial adequacy, it is up to lawmakers to make decisions to support the Trust Fund, providing nearly 60 million Americans with a significant portion of their total monthly income. The Board of Trustees strongly recommends lawmakers address the projected trust fund shortfalls. This will allow for the gradual implementation of necessary changes, giving workers and beneficiaries time to adjust to them. Making changes now allows the impact to be felt at smaller intervals for larger groups of people versus a more significant impact on small groups. Social Security is expected to “play a critical role in the lives of 68 million beneficiaries and 184 million covered workers and their families during 2024.” Making thoughtful, informed decisions can help protect these benefits for future generations.

The story is much the same as it relates to the two Medicare Trust Funds. Perhaps irrevocably changed as a result of the COVID-19 pandemic, the outlook of the Health Insurance Fund has improved, but costs continue to rise, and like the Social Security Administration, benefits paid out continue to exceed the income received. In 2023, Medicare provided coverage for nearly 70 million Americans, most over age 65. The number of Medicare beneficiaries is expected to continue to grow steadily, and so, without enacting solutions, insolvency is a genuine worry. The Trustees note, “[t]he early introduction of reforms increases the time available for affected individuals and organizations – including health care providers, beneficiaries, and taxpayers – to adjust their expectations and behavior.

The solvency of the Social Security and Medicare programs is of the utmost importance to the team at Brown & Brown Absence Services Group. We will continue to monitor updates from the federal government closely and will keep our clients apprised of any changes they should be aware of. If you have any additional questions about the Trust Funds, you may reach out to your local Social Security office or Brown & Brown directly.