These factors, sometime referred to as “non-medical drivers,” can be responsible for longer claim durations and fewer successful return to work outcomes.

Understanding non-medical drivers

Issues of claimant motivation, perceptions of functional loss, perceived barriers to returning to work, and possible secondary gain can have far more impact on our ability to facilitate successful outcomes than the more obvious clinical issues. Given the emergence of a mental health crisis from COVID-19, the need for a holistic claim management approach that can uncover those issues early within the life of a claim has never been greater.

The emerging mental health crisis

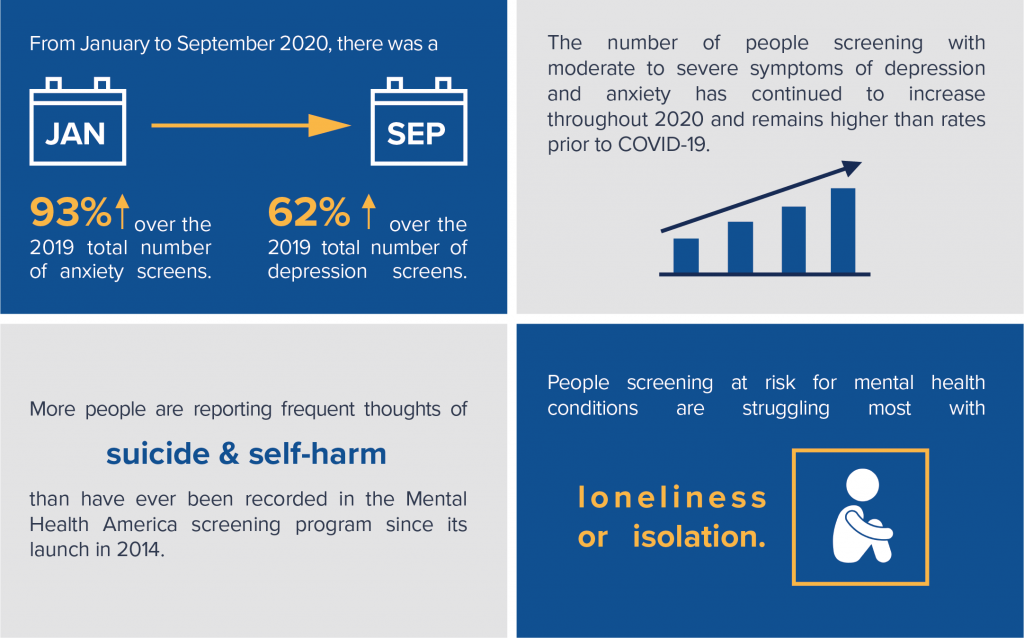

Few will argue that the impact of COVID-19 over the past nine months has resulted in a mental health crisis within our society. In Mental Health America’s recent report, “COVID-19 and Mental Health: A Growing Crisis,” the findings were sobering. A few of the headlines included the following:

Managing this crisis

In the past, there were certain elements of a claim management model that were required to effectively manage complex claims, including:

- A claim-block segmentation strategy that aligns claim complexity with claim analyst proficiency.

- Claim management protocols that facilitated effective and efficient use of resources.

- Skilled and knowledgeable claim analysts to conduct robust, detailed claimant interviews.

While we are just starting to see how and to what extent the mental health crisis will manifest, one thing is certain: innovative and creative approaches to claim management will be rewarded.

Notably, tools like a psychometric claimant questionnaire are proving to be an effective way of uncovering non-medical drivers. The results of these questionnaires identify key issues a behavioral health clinician or claim analyst can explore more deeply when conducting a detailed claimant outreach. Leveraging the perspective gained from this process early within the claim can result in an improved understanding of a whole-person function and the identification of real and perceived barriers to the claimant’s successful return to work.

How Brown & Brown Absence Services Group can help

Brown & Brown Absence Services Group is dedicated to finding creative solutions to support carriers during what many expect to be an increase in claim incidence and complexity. We have created innovative offerings that leverage the use of psychometric questionnaires, including our new Behavior Health Case Management solution.

Our team of seasoned claim professionals is prepared to support your organization in effectively managing complex claims. Contact Brown & Brown Absence Services Group to discuss how we can provide this innovative support to your claim organization.

Mark Sawyer, CLU

Vice President, Claim Performance Solutions

(207)747-4308 | [email protected]