As we turned the corner from 2020 to 2021, many of us looked forward with optimism. Businesses had regained some sense of footing, socially we’d achieved a certain comfort level with how to operate, and a vaccine for all was on the horizon. We’d hoped that uncertainty – or at least so much of it – was in the past. However, knowing how many factors influence absence and disability claims management, we published a blog post in January predicting that uncertainty in the market would keep carriers on their toes throughout 2021.

While certain key indicators for our industry have stabilized, the global and domestic dynamics dominated by COVID-19 continue to be a bouncing ball. This has been evident in the variance of vaccination rates state by state, as well as with the emergence of the Delta variant and with what some are considering the third wave of the pandemic.

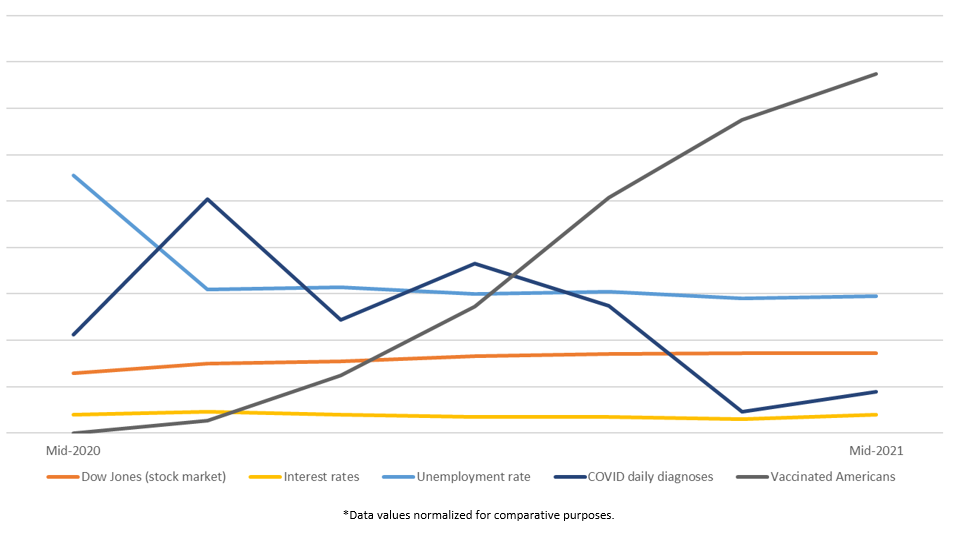

Economically, we’ve seen the stock market continue to be bullish and interest rates remain low, with experts predicting much of the same through the end of the year. Likewise, we’ve seen the unemployment rate more than cut in half from where it was the middle of 2020. With that, we’ve faced the – perhaps – unanticipated challenges of a limited labor pool, difficulties recruiting skilled workers, and the impacts of the “great resignation” as employees reevaluate their true needs coming out of a tumultuous year. Amongst other factors, this will likely produce a boost to the employee benefits and voluntary benefits market, as employers compete for talent.

As these trends relate directly to our industry, we’ve seen the greatest increase in demand for life benefits since the mid-80s, as consumer concern over COVID drove them to ensure protection for their families. Of course, the mortality rates due to the virus have also meaningfully increased the payout of benefits. While the first half of the year did demonstrate a resurgence of diagnostic testing and elective surgeries that had been postponed due to COVID, the Delta variant has led more than 100 hospitals nationwide to, once again, put a pause on these procedures – a trend that may grow dependent on the demand for medical resources in the coming months.

While the economy is certainly “back open for business,” and the prospects for growth are strong, we still need to look ahead with a judicious mind and the ability to flex for the unexpected. In our industry in particular, the impacts of COVID and long-haul COVID as it relates to short- and long-term disability claims, as well as life and annuities, are far from mature and many uncertainties still lie ahead.