On June 2nd, the Social Security Board of Trustees released its annual report on the long-term financial status of the Social Security Trust Funds. Despite being released nearly three months earlier than the 2021 annual report, there was still a lengthy delay as the report is due by April 1st every year. As with its predecessor, the 2022 report projects an early depletion of trust funds in the wake of the COVID-19 pandemic. This worrisome trend caught the eye of lawmakers long before the pandemic began. Even with projected early depletion, the release of the 2022 report shows that the outlook on the status of the trust funds has improved since last year.

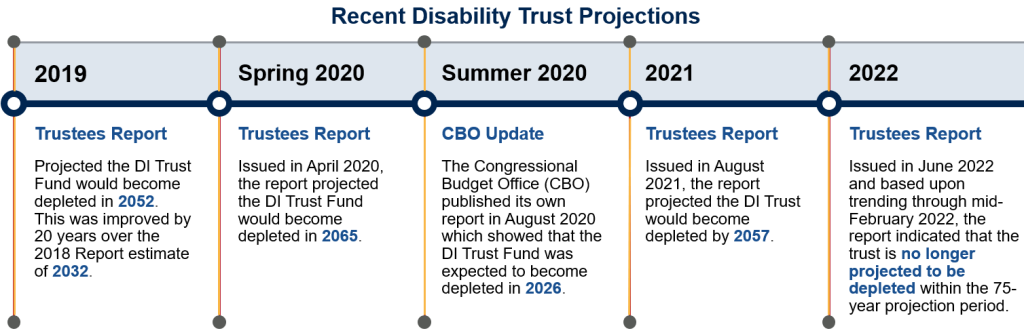

The 2021 report estimated that the retirement trust fund would support full benefits through 2033, one year earlier than reported the previous year, and then be able to pay 76% of scheduled benefits. It was also estimated that the disability trust fund would support full benefits through 2057, eight years earlier than the previous year’s estimate, at which time only 91% of scheduled benefits would be payable. These projections have been updated with the release of the 2022 report. This year’s report estimates that the combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance (OASI and DI) Trust Funds will become depleted in 2035; one year later than projected last year, with only 80% of benefits payable at that time. When considered separately, the individual trust funds tell a different story. It is estimated that the OASI (i.e., Social Security Retirement and Widow(ers) benefits) Trust Fund reserves will become depleted in 2034. For the first time since the 1983 Trustees Report, however, the DI Trust Fund reserves are not expected to be depleted within the 75-year long-range projection period (2022 – 2096).

The Trustees note that this report sets forth the actuaries’ best estimates of the effects of the COVID-19 pandemic on the Trust Funds, but estimates may change in the face of economic uncertainty, saying: “The pandemic is projected to have continuing significant effects on the OASI and DI programs in the near term, and the future course of the pandemic is uncertain. However, the economic recovery from the brief recession in 2020 has been stronger and faster than assumed in last year’s report. On balance, the projected long-range actuarial status of the OASI and DI Trust Funds has been little changed by the effects of the pandemic and ensuing recession, considering both the effects realized to date and those yet expected. The Trustees will continue to monitor developments and modify the projections in later reports.”

The Trustees note that the primary reason for the improved outlook for the DI Trust Fund is that the Social Security Disability program continues to have low levels of disability applications and benefit awards, even in the wake of the COVID-19 pandemic. Disability applications have declined substantially since 2010, and the total number of disabled-worker beneficiaries in current payment status has been falling steadily since 2014. For this report, however, the Trustees assume that disability applications will rise gradually from current low levels.

The funding of the Social Security Administration (SSA)’s retirement and disability trusts have long been a source of concern and deliberation for lawmakers. The impacts of COVID-19 have caused a more acute challenge as SSA is once again expecting to pay more benefits than income received in 2022. The total cost of the program in 2021 was $1,145 billion, five percent higher than the total income of $1,088 billion ($1,018 billion in non-interest income and $70 billion in interest earnings). The Trustees anticipate this trend to continue in the years to come due to an expected increase in claim activity. The Trustees recommend that lawmakers address the projected trust fund shortfalls soon to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them. “Implementing changes sooner rather than later would allow more generations to share in the needed revenue increases or reductions in scheduled benefits. Social Security will play a critical role in the lives of 66 million beneficiaries and 182 million covered workers and their families during 2022. With informed discussion, creative thinking, and timely legislative action, Social Security can continue to protect future generations.”

The 2022 report can be read in its entirety here.

Additional sources:

2019 annual report

2020 annual report

September 2020 Congressional Budget Office report