Talk of the debt ceiling has dominated headlines since early 2023 when the treasury department began using extraordinary measures to allow the federal government to pay its obligations in full and on time. For the ninth time since the 2011 debt ceiling crisis, the debt ceiling was raised in December 2021 to $31.381 trillion to sustain federal borrowing authority for the following year. When that deal expired on January 19, 2023, the Treasury had no choice but to enact extraordinary measures to prevent default. With no ceiling suspension or limit increase on the horizon, time is of the essence. As we move closer to June 1st, a date many experts predict the government will officially hit the ceiling, the threat of a government default continues to loom.

What are extraordinary measures?

Extraordinary measures allow the government to use cash-on-hand and a variety of accounting maneuvers to pay for the country’s debts. These measures include prematurely redeeming Treasury bonds held in federal employee retirement savings accounts, halting contributions to certain government pension funds, suspending state and local government series securities, and borrowing from money set aside to manage exchange rate fluctuations. Once the Treasury Department can no longer take extraordinary measures to pay the debts, it will begin defaulting on some debts. While these extraordinary measures have provided the government with some breathing room, it is only an action of delay, not resolution. Extraordinary measures will not raise the debt ceiling and cannot prevent a default.

Hitting the debt ceiling: what it could mean

Earlier this year, United States Secretary of the Treasury Janet Yellen wrote to Congressional Leadership warning of the consequences should the country default on debt, noting “failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans and global financial stability.” If Congress cannot reach an agreement to suspend or increase the debt ceiling, we can expect multiple consequences across the country, including higher interest rates, market panic, political instability, and slashed government services.

While the government has not hit the statutory limit, the mere possibility of a default is responsible for a wave of uneasiness making its way across the United States and around the world. The United States has never defaulted on its debts before, but as a significant player in the worldwide economy, an economic and politically sound United States is vital to ensuring stability worldwide.

The impact of a default on much-needed services

For millions of Americans relying daily on federally funded services, a default could create massive financial hardship. If Congress cannot resolve the debt ceiling crisis, various government payments will be affected, including funding for food stamps, federal grants to states and municipalities for Medicaid, highways, education, and other programs, and paychecks to federal workers and the military. For entitlement programs, such as Social Security and Medicaid, the law requires the government to continue payments, even in the case of a default. However, the government will no longer be able to borrow funds to pay for these programs. If there is no available cash on hand, benefits will not be paid right away.

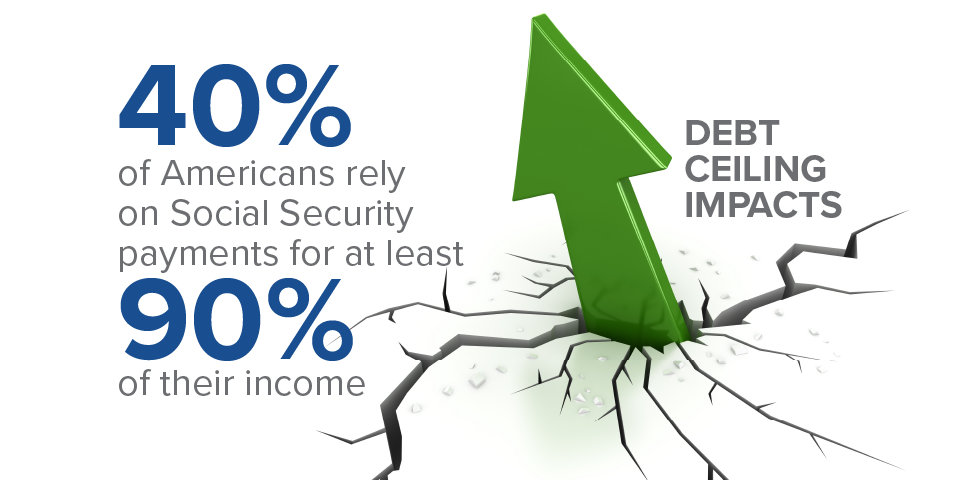

If any of the 65 million Americans currently receiving payments from the Social Security Administration do not receive timely payments because of a default, they will receive payments for missed benefits once the debt ceiling is raised. However, that timeframe is uncertain and may not be good enough for those most in need. Approximately 40% of beneficiaries rely on Social Security payments for at least 90% of their income. For the remaining 60% of beneficiaries, a majority consider Social Security payments to be at least half of their monthly income.

In addition, a default may disrupt the services provided for older and disabled Americans on Medicare and low-income households relying on Medicaid. Nearly half of the population of the United States, a combined 158 million Americans, are enrolled in Medicare and Medicaid. With providers becoming increasingly unhappy with the administrative burdens associated with Medicare and Medicaid claims and low reimbursement rates, Americans on Medicare and Medicaid may have difficulty obtaining care at their preferred providers.

Federal workers could feel the impact, too

Along with the millions of Americans relying on federally-funded services, a government default may also result in financial hardship for federal employees. In addition to having no money to fund programs and services, the government will not have the money to fund paychecks for its workers completing vital tasks such as awarding Social Security benefits or approving Medicare enrollments. When the government shut down in the past, hundreds of thousands of employees were placed on furlough. While hitting the debt ceiling is not a government shutdown, there is talk of furloughing employees should the debt ceiling not be raised.

While a furlough would not cause all work to halt immediately, only essential functions, such as paying ongoing monthly cash benefits to eligible beneficiaries, will continue. With a steadily increasing backlog and continuous new applications, a furlough would only add more delays to already overloaded programs for agencies such as the Social Security Administration.

Where do we go from here?

A Moody’s Analytics report released earlier this year estimated that a government default could have significant macroeconomic consequences, including a 4% GDP decline, an estimated 6 million jobs lost, and an unemployment rate surpassing 7%, which can last months or even years. As is typical when we see a significant economic decline, this is expected to raise the demand for programs such as the Social Security Disability Insurance program, putting further strain on an already struggling payment system. While we remain hopeful about Social Security’s 2024 Fiscal Year budget, the debt ceiling crisis could significantly and negatively impact the budget and expected appropriations. In fact, we expect a delay in the appropriations for the 2024 Fiscal Year until the debt ceiling crisis has subsided. A delay on a system already struggling may worsen the conditions even more before they get better.

Although it has never previously occurred, the United States has once come close to a default in the past – in August 2011. At Brown & Brown Absence Services Group will continue to monitor the status of the debt ceiling and Congressional actions taken in the upcoming weeks and report on any significant findings. If you have any additional questions about the impact a government default may have, please reach out to us directly.