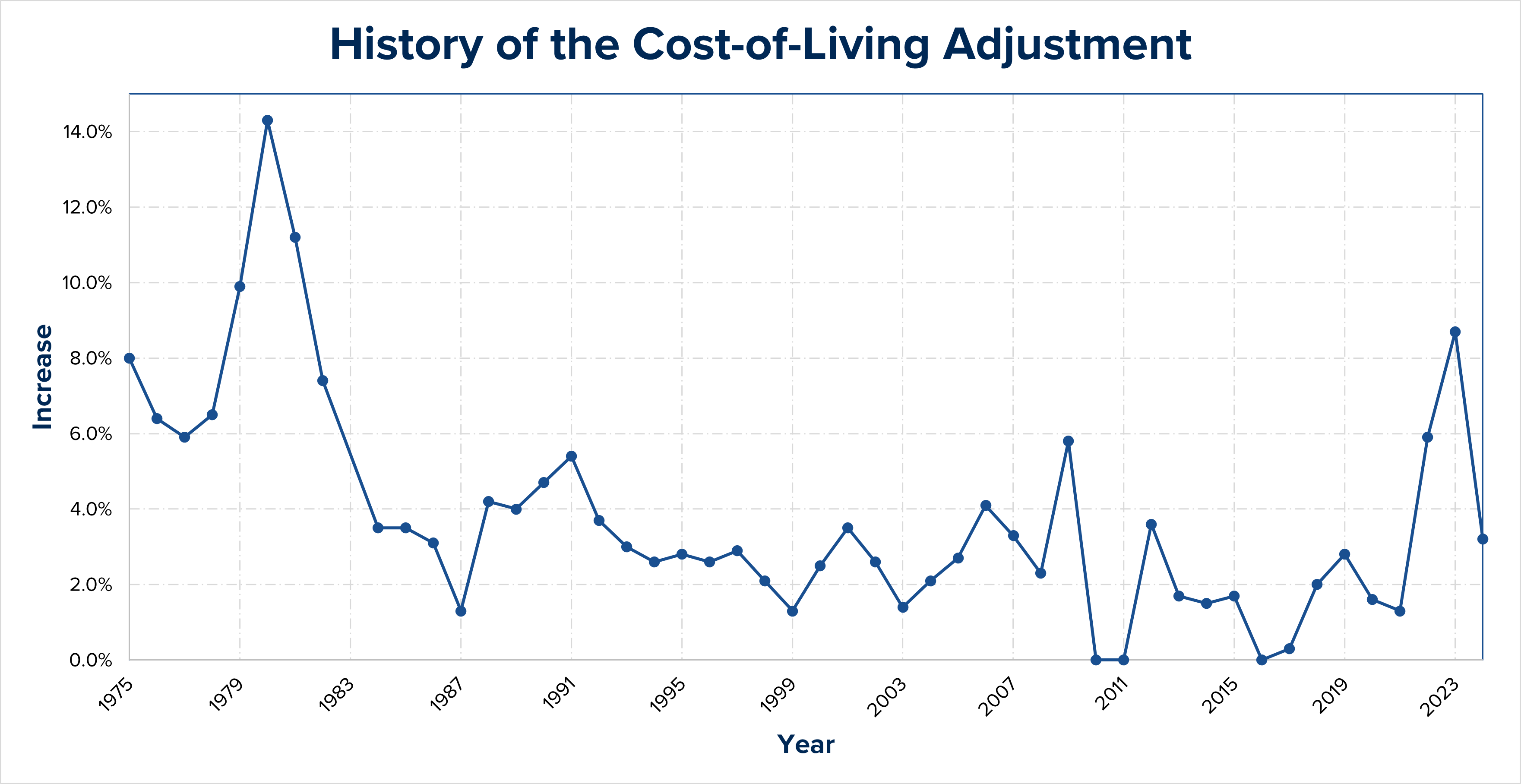

Earlier today, the Social Security Administration (SSA) announced a 3.2% Cost-of-Living Adjustment (COLA) for all Social Security and Supplemental Security Income (SSI) beneficiaries. While the 3.2% is significantly lower than last year’s historic 8.7% COLA adjustment, it remains higher than the average adjustment of 2.6% we have seen over. The COLA adjustment will give nearly 67 million Americans, including anyone receiving benefits as a dependent on a Social Security beneficiary’s record, an increase in their December 2023 payment, which is payable in January 2024. An additional 7.5 million SSI benefit recipients will see an increase in benefits beginning December 31, 2023.

Why is the Cost-of-Living Adjustment important?

Each year, Social Security will typically implement an increase in benefits that provides vital additional income to those who rely on the payments for their daily living and associated costs. As daily expenses increase, including costs related to healthcare coverage, a healthy Cost-of-Living Adjustment provides beneficiaries with a cushion for further expenses and ensures the purchasing power of benefits is not eroded by inflation .

The history of the Cost-of-Living Adjustment

The Cost-of-Living Adjustment was not originally intended to be an annual automatic increase for Social Security and Supplemental Security Income beneficiaries. Before 1972, a COLA was only implemented when Congress enacted special legislation. Then, in 1972, Social Security implemented annual Cost-of-Living Adjustment allowances, providing beneficiaries with an annual increase tied to the Consumer Price Index (CPI-W) starting in 1975. For the first seven years, COLAs were payable for Social Security benefits paid in June and received in July. Beginning in 1982, Social Security moved the Cost-of-Living Adjustment to December to become payable in January.

What happens now?

All Social Security and Supplemental Security Income beneficiaries and their dependents will automatically receive the Cost-of-Living Adjustment in their December 2023 check. No action is required from the recipient to receive the increase. Starting in December, beneficiaries can verify their new benefit by logging into their my Social Security account. Any deductions, including Medicare premiums and voluntary tax withholding, will automatically adjust in accordance with their new benefit amount.

If you have questions about the new Cost-of-Living Adjustment and its impact on your benefits, you may contact Brown & Brown Absence Services Group today or reach out to your local Social Security office.

You can learn more about this year’s Cost-of-Living Adjustment here.

Nothing in this post is intended as advice or a suggestion to elect or not elect to claim benefits of any kind, including Social Security benefits, nor is it intended as financial advice in any way. The decision to claim benefits is a personal one that is contingent upon each individual’s unique circumstances. Nothing herein is considered medical advice, diagnosis, or treatment.