For more than 50 million Americans, a Medicare Part D plan provides prescription drug coverage. As is often the case with other Medicare options, Part D plans range in both cost and coverage, increasing the complexity when determining which plan best fits the beneficiary’s unique financial and medical needs. While this process may be complicated, it is also incredibly important. When choosing which plan to enroll in, beneficiaries are urged to consider what coverage the plan provides and where any gaps in coverage may lie. One such common coverage gap is known as the “donut hole.”

What is the Medicare Donut Hole?

The Medicare Part D donut hole, or coverage gap, refers to the Part D prescription drug coverage stage when Medicare beneficiaries have met certain out-of-pocket thresholds and must pay a larger portion of their prescription drug costs until they reach the catastrophic coverage level. Initially, the cost-share requirements in the donut hole were much higher, with instances of beneficiaries paying 100% of prescription drug costs once they reached this stage. Legislative changes in recent years have reduced the share, and now, while in the donut hole, beneficiaries will be responsible for up to 25% of prescription costs. It is important for Medicare beneficiaries to understand the various stages of Part D coverage, including the donut hole, to prepare for potential fluctuations in their out-of-pocket expenses throughout the year.

Stages of Part D prescription drug coverage

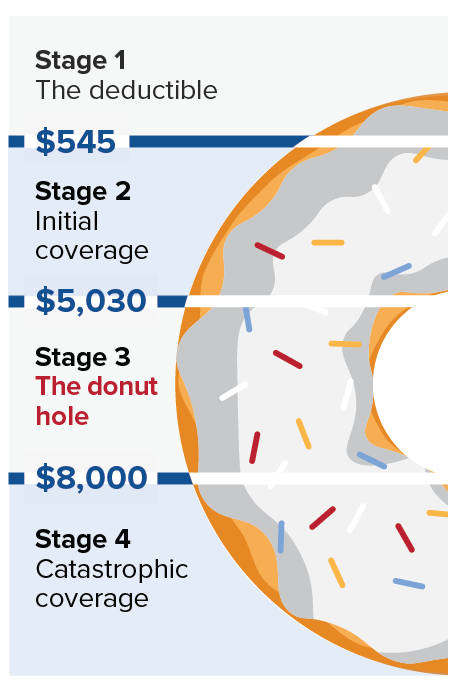

Medicare Part D plans typically have four stages of coverage for prescription drugs. These plans last from January 1st through December 31st and reset the following calendar year:

Stage 1 – The deductible: At this stage, beneficiaries must pay 100% of prescription costs until the deductible is met before the drug plan will begin to cover its share. Deductibles will vary among plans, but each year, the Centers for Medicare and Medicaid Services (CMS) establish a cap that plans cannot exceed. For 2024, the deductible cannot exceed $545.

Stage 1 – The deductible: At this stage, beneficiaries must pay 100% of prescription costs until the deductible is met before the drug plan will begin to cover its share. Deductibles will vary among plans, but each year, the Centers for Medicare and Medicaid Services (CMS) establish a cap that plans cannot exceed. For 2024, the deductible cannot exceed $545.

Stage 2 – Initial coverage: After reaching the deductible, the drug plan begins to cover its share. If the plan utilizes copays, the beneficiary may expect to pay a standard amount per drug based on the prescription tier. For beneficiaries with coinsurance, the amount they pay may vary throughout the year depending on the cost of the drug. Once the beneficiary and the plan have paid the CMS established maximum, the beneficiary will move into the donut hole. In 2024, the maximum is $5,030, which includes the deductible.

Stage 3 – The coverage gap (or, the donut hole): Once beneficiaries reach this stage, a limit is placed on what the drug plan will pay for covered prescriptions. Once in the gap, beneficiaries pay no more than 25% of the cost of brand-name and generic prescription drugs covered by the drug plan, with the plan paying the rest. In addition, the beneficiary must pay 25% of the dispensing fee associated with brand-name drugs. Beneficiaries will remain within the donut hole until the CMS-designated out-of-pocket cost is met. For 2024, this limit is $8,000 and includes the deductible, coinsurance, copayments and the cost of covered prescriptions, not including any dispensing fees.

Stage 4 – Catastrophic coverage: Beneficiaries move to the catastrophic coverage stage after the out-of-pocket-cost threshold is met. At this stage, beneficiaries will pay nothing for covered Part D drugs and remain at this stage until the following calendar year.

Is it possible to avoid the donut hole?

The donut hole only applies to beneficiaries who utilize Part D for prescription drug coverage. Even still, not everyone will fall into the donut hole. For those concerned about coverage costs, there are options to help avoid it.

-

- Compare prescription drug plans each year: As with most healthcare and medical coverage, prescription drug plans can change each year. Beneficiaries should review coverage each year to determine if their plan still provides the best possible coverage for their unique financial and medical needs.

- Utilize generics over brand-name drugs: In many instances, generic prescriptions are available at significant cost savings. If an option is available and the beneficiary’s medical provider is comfortable with a generic drug instead of a name-brand drug, choosing that may be more cost-effective.

- Look into Extra Help: Medicare’s Extra Help program is designed to help beneficiaries with limited income and resources pay for premiums, deductibles, coinsurance, copays, and other costs. Those who qualify for the Extra Help program will not enter the donut hole.

Seek experienced guidance

Contact Aevo Insurance Services, a division of Brown & Brown Absence Services Group, to speak with an experienced licensed insurance agent about your Medicare options, including those for Part D plans. Our guidance extends through every step of the enrollment process, starting with helping select a Medicare plan that meets your unique medical and financial needs.

This information is up-to-date as of January 2024 based on information made public at that time. For the most recent information, visit the source links.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.