Starting next week, Medicare beneficiaries have the option to make changes to their existing healthcare and prescription drug coverage. Each year during the open enrollment period – Medicare’s Annual Election Period (AEP), which runs from October 15th through December 7th – beneficiaries may select a new plan, add additional coverage, or make other applicable changes to their health care benefits as needed. Any changes that are made during this time will become effective January 1st of next year.

What changes can be made during AEP?

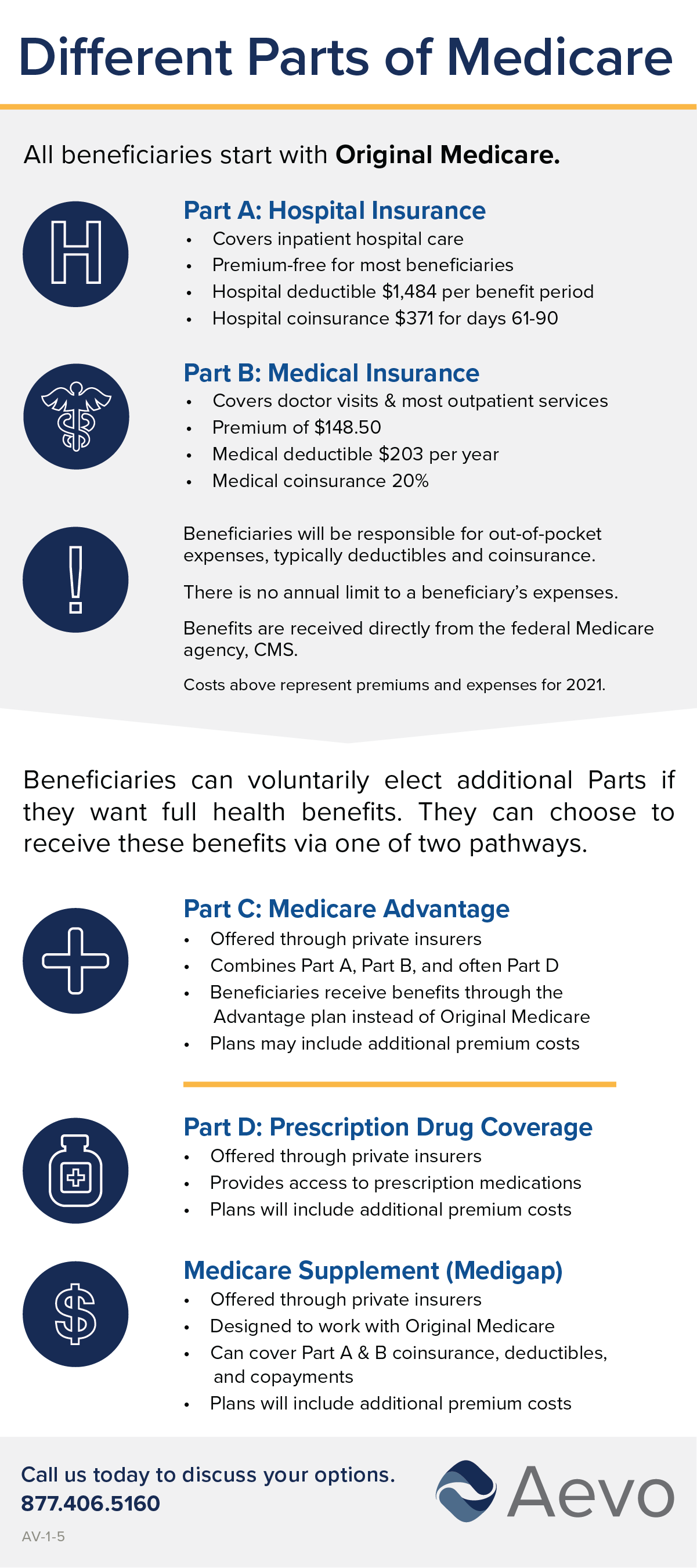

Beneficiaries who receive their coverage through Original Medicare, receive additional coverage through a Medicare Advantage Plan, or utilize Part D prescription drug coverage have the chance to make changes during AEP. The changes beneficiaries can make include:

-

-

- Moving from Original Medicare to a Medicare Advantage Plan

- Moving from a Medicare Advantage plan to Original Medicare

- Changing Medicare Advantage plans

- Adding Part D prescription drug courage

- Changing Part D prescription drug plans

- Disenrolling in Part D prescription coverage

-

The advantage of a Medicare Advantage Plan

There is a lot to consider when reviewing Medicare options. Medicare Advantage plans offer coverage that Original Medicare does not cover including dental, vision, hearing, prescription drugs, and fitness programs. Some Medicare Advantage plans even offer additional benefits such as transportation to medical appointments, as well as meal deliveries and services that promote health and wellness.

AEP is not the general enrollment period

While AEP provides the opportunity to adjust health care coverage, not everyone enrolled in Medicare will be able to participate in AEP. If a beneficiary delayed enrolling in Medicare during their original entitlement to benefits, they are unable to take part in AEP and must instead wait until the general enrollment period (GEP), which lasts from January 1st through March 31st. Beneficiaries currently supplementing their Original Medicare coverage through a Medigap plan also will be unable to participate in AEP.

Speak with an experienced Licensed Insurance Agent

Medicare can be complicated and making an informed decision about coverage is important. Speaking with a licensed insurance agent can ensure Medicare guidance and support during a critical decision-making period. Agents can provide a complete overview of Medicare, thus eliminating any confusion that one may experience at the start.

Contact Aevo Insurance Services, a division of Brown & Brown Absence Services Group, to speak with an agent about your Medicare options. Guidance extends through every step of the enrollment process, starting with helping select a Medicare plan that meets unique medical and financial needs.