Ahead of Medicare’s Annual Election Period (AEP), the Centers for Medicare & Medicaid Services (CMS) have announced the 2024 Medicare Part A and Part B premiums, deductibles, and coinsurance amounts, as well as the income-related monthly adjustment amounts of Medicare Part D. Each year Medicare premiums are adjusted in accordance with the Social Security Act. After premiums and deductibles decreased for the first time in ten years in 2023, costs are expected to rise in 2024.

The cost of Medicare in 2024

Most beneficiaries will continue to receive benefits from Medicare Part A (“hospital insurance”) at no cost. The Part A deductible, however, will increase slightly, going from $1,600 in 2023 to $1,632 in 2024. Medicare Part A typically covers inpatient hospital care, skilled nursing facility care, hospice care, home health care, and nursing home care. Medicare Part B (“medical insurance”) premiums will increase from $164.90 in 2023 to $174.70 in 2024. In addition, the annual deductible for all Medicare Part B beneficiaries will increase by $14 from $226 to $240 in 2024. Medicare Part B typically covers doctor visits, outpatient services, preventative care, durable medical equipment (DME), and medically necessary services.

CMS also recently announced that average costs for Medicare Part C (“Medicare Advantage”) and Part D (“Medicare drug coverage”) are expected to remain stable in 2024. While CMS is not responsible for establishing monthly costs for Advantage and prescription drug plans, information is released each year to provide guidance and support for beneficiaries as they choose their medical coverage for the upcoming year. CMS estimates that the average cost of a Medicare Advantage plan will increase slightly from $17.86 in 2023 to $18.50 in 2024. On the other hand, the average cost of a Part D plan is expected to decrease, down from $56.49 per month in 2023 to $55.50 per month in 2024.

Additional relief related to prescription costs

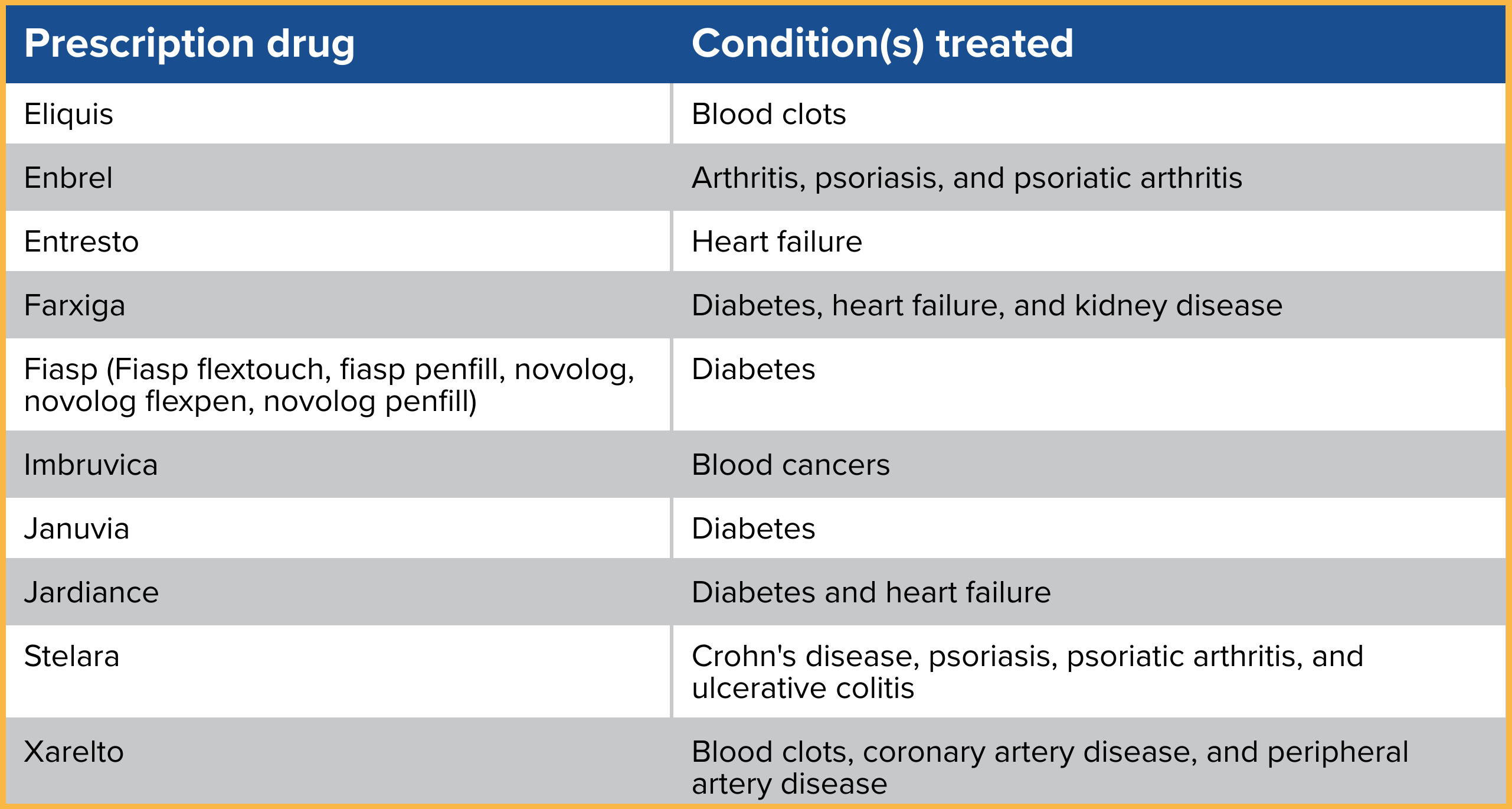

The Biden-Harris Administration has devoted significant resources to help address the rising costs of healthcare in the United States, particularly for those Americans relying on Medicare. In August 2022, President Biden signed the Inflation Reduction Act (IRA) into law, which sets forth several provisions to generate savings on prescription drugs and limit costs associated with Medicare. The United States Department of Health and Human Services attributes the IRA with strengthening protections for seniors and disabled individuals relying on Medicare. One provision of note allows Medicare to negotiate directly with drug companies on the cost of brand name prescription drugs. Medicare will negotiate prices for up to 60 drugs by 2026 and will continue to negotiate costs for up to 20 additional drugs per year after that. These negotiations will provide millions of Americans with crucial cost savings on often life-saving treatments.

In August, President Biden announced the first ten drugs on which Medicare will begin negotiating, with any negotiated costs expected to go into effect in 2026.

Making an informed decision

Medicare’s Annual Election Period runs from October 15th through December 7th. The licensed insurance agents at Aevo Insurance Services, a division of Brown & Brown Absence Services Group, are available to offer Medicare guidance and support during this critical decision-making period. Contact your agent at Aevo today to discuss your individual coverage needs.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.